Sanken Notice of Change of Consolidated Subsidiary

January 27, 2023

Sanken Electric Co., Ltd.

Capital Increase through Third-Party Allotment

To whom it may concern,

Sanken Electric Co., Ltd. (“Sanken”) hereby announces that its Board of Directors decided today to formally

authorize Polar Semiconductor, LLC (“PSL”), a consolidated subsidiary of Sanken in the United States, to seek

a majority third-party investment from One Equity Partners (including the fund managed by One Equity

Partners, hereafter referred to as “OEP”), based upon the discussion to date among Sanken, Allegro (the current

minority equity holder of PSL) and OEP with respect to such potential investment and related contracts. Upon

execution of a majority third-party investment into PSL, PSL will not be a consolidated subsidiary of Sanken

and will become an equity-method affiliate of Sanken. Sanken will announce the schedule and other details if

and when final definitive documents are executed relating to such majority investment.

Background and reasons for implementation

We are now facing with the need to respond to unprecedented changes in the business environment, such

as disruptions in the global semiconductor supply chain and the emergence of geopolitical risks. Sanken

is also reviewing our basic production strategy. In response to such changes in the business environment,

Sanken has decided to shift to a “Fab-Light Strategy,” that is, to secure substantial production capacity

while curbing the burden of investment in wafer production facilities by adopting a management style

that incorporates outside capital and human resources.

In addition, in order to expand the production capacity of PSL, which has been responsible for our wafer

production in the U.S., and to take full advantage of its position as a wafer fab located in the U.S., Sanken

and Allegro MicroSystems, Inc. (hereafter referred to as “Allegro”) will continue to be the core of the

PSL’s customer base, while raising capital through a third-party allocation of new shares to OEP, a private

equity fund, as a source of investment capital (hereafter referred to as the “transaction”), and also pursuing

grants under the US Chips Act. After expanding its production capacity in the second half of the fiscal year

2025, PSL will be transformed into a U.S.-based foundry company engaged in the contract wafer

manufacturing business, including new customers, and will aim for further growth in the future. There is

a significant opportunity for PSL with its unique high voltage and sensor capabilities to dramatically

increase the scale and efficiency of its operations which will have meaningful long-term benefits to all of

Polar’s customers. The contemplated transaction will allow Polar to nearly double capacity if Polar is able

to participate in the Chip’s Act Program. Polar will become a leading automotive, aerospace, and

specialized process fab, and Sanken will have access to more capacity at a better long-term overall cost.

Sanken implemented various structural reforms in the past, such as closing or transferring peripheral

businesses and consolidating plants in the semiconductor back-end process. By implementing the “Fab

Light Strategy” in the semiconductor front-end process, we aim to further enhance our corporate value by

increasing our competitive advantage in power semiconductors and achieving sustainable growth.

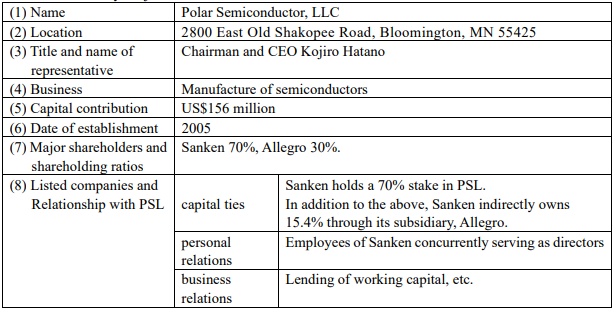

Outline of the subsidiary subject to the transaction

*The operating results and financial condition of PSL for the last three years are undisclosed per an

agreement.

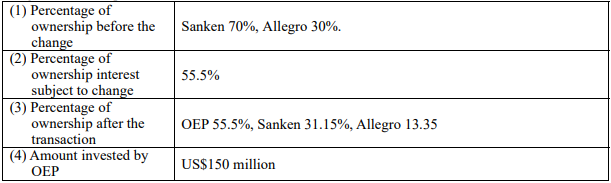

Percentage of ownership and amount of investment before and after the transaction

*(2) through (4) are the current plans.

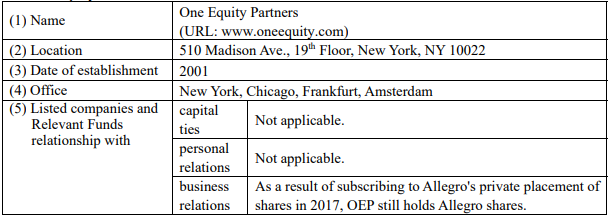

Outline of the equity investor

Schedule

Date of Board resolution January 27, 2023

Impact on this year’s earnings forecast

The impact of the transaction on the consolidated financial results will be disclosed as soon as the

matters to be announced are known.